Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. With interest rates still hovering around 4%, locking in a low monthly payment now really makes sense.

Those thinking about a larger home should realize that waiting to make the move while mortgage rates are increasing probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain budget for your monthly housing costs.

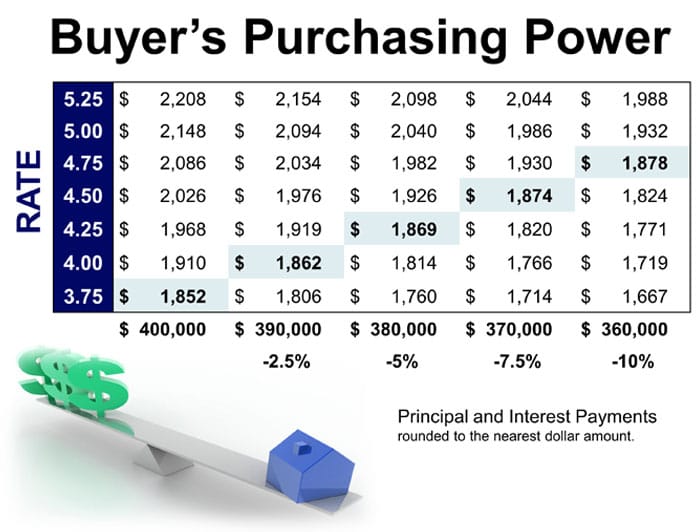

The chart above details this point. With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000). Experts predict that mortgage rates will be closer to 5% by this time next year.

Likewise, some are waiting for the value of their current home to rise before moving to the larger home. However, prices are rising across the board. If homes prices increase the same percentage across all price levels, the price of the larger home you are looking to move to just went up by more than what you made on your smaller home by waiting a year.

If you are considering moving up to a larger home, or downsizing for that matter, give us a call for a seller consultation. We can give you a real good idea of what your current home will sell for, and working with a lender, we can help you find the right price point for the larger home you have dreamed about at a mortgage level you are comfortable with.

Act now to get the most house for your hard-earned money. Contact us for more information.